Financial technology has rapidly evolved, with money-saving apps leading the charge in this revolution. These apps employ numerous strategies to transform saving money from a chore into an enjoyable activity. Wondering which one suits you best? After comparing countless options, we’ve curated a list of the top five money-saving apps on the market today.

These money-saving apps can help you manage your finances more effectively and reach your saving goals faster. Whether you’re looking to create an emergency fund, track spending, deposit money into fintech banking accounts or traditional savings accounts, or invest spare change, there’s an app tailored to meet your needs.

Many money-saving apps incorporate beneficial features like budgeting tools, automatic saving options, and even the ability to round up purchases to the nearest dollar, making the saving process seamless and straightforward.

Best Apps to Help Save Money (Compared)

| App Name | Features | Pricing | Free Available | List Price | Android | iOS | Web Version |

|---|---|---|---|---|---|---|---|

| Acorns | Round-Ups ✅ FDIC-Protected Checking ✅ Linked Checking ✅ No Minimum Balance/Overdraft Fees ✅ Unlimited Free/Rebate ATM Withdrawals ✅ Acorns Later (IRA) ✅ Acorns Earn ✅ Learn Feature ✅ | $3/month (Personal), $5/month (Personal Plus), $9/month (Premium) | Yes | $3-$9/month | Download | Download | Web Version |

| Chime® | Automatically Save While Spending ✅ Automatically Save When Paid ✅ Competitive APY ✅ Get Paid Early ✅ SpotMe® ✅ No Fees ✅ Revenue Model ✅ | Free | Yes | Free | Download | Download | Web Version |

| Qapital | Rule-Based Savings ✅ Qapital Visa Debit Card ✅ FDIC-Insured Account ✅ Qapital Invest ✅ Customizable Goals ✅ Automatic Transfers ✅ | $3/month (Basic), $6/month (Complete), $12/month (Master) | Yes | $3-$12/month | Download | Download | App Only |

| Oportun Set and Save | Automation & AI ✅ Spending Goals ✅ FDIC-Insured ✅ Savings Bonus ✅ Overdraft Protection ✅ | $5/month | Yes (1 year) | $5/month | Download | Download | App Only |

| Rocket Money | Spending Analysis ✅ Budgeting Tools ✅ Bill Negotiation ✅ Subscription Cancellation ✅ Automated Saving Options ✅ Net Worth Insights ✅ Bill Tracking ✅ | Free, Premium $4-$12/month | Yes | $4-$12/month | Download | Download | Web Version |

| Albert | Albert Cash Account and Debit Card ✅ Albert Budgeting ✅ Albert Investing ✅ Albert Protect ✅ | Free, Genius $14.99/month | Yes | $14.99/month | Download | Download | App Only |

| Allo | Mindful Budgeting ✅ Introductory Course ✅ Expense Flagging ✅ Emotional Awareness ✅ | $49.99/year | Yes (14 days) | $49.99/year | Download | Download | App Only |

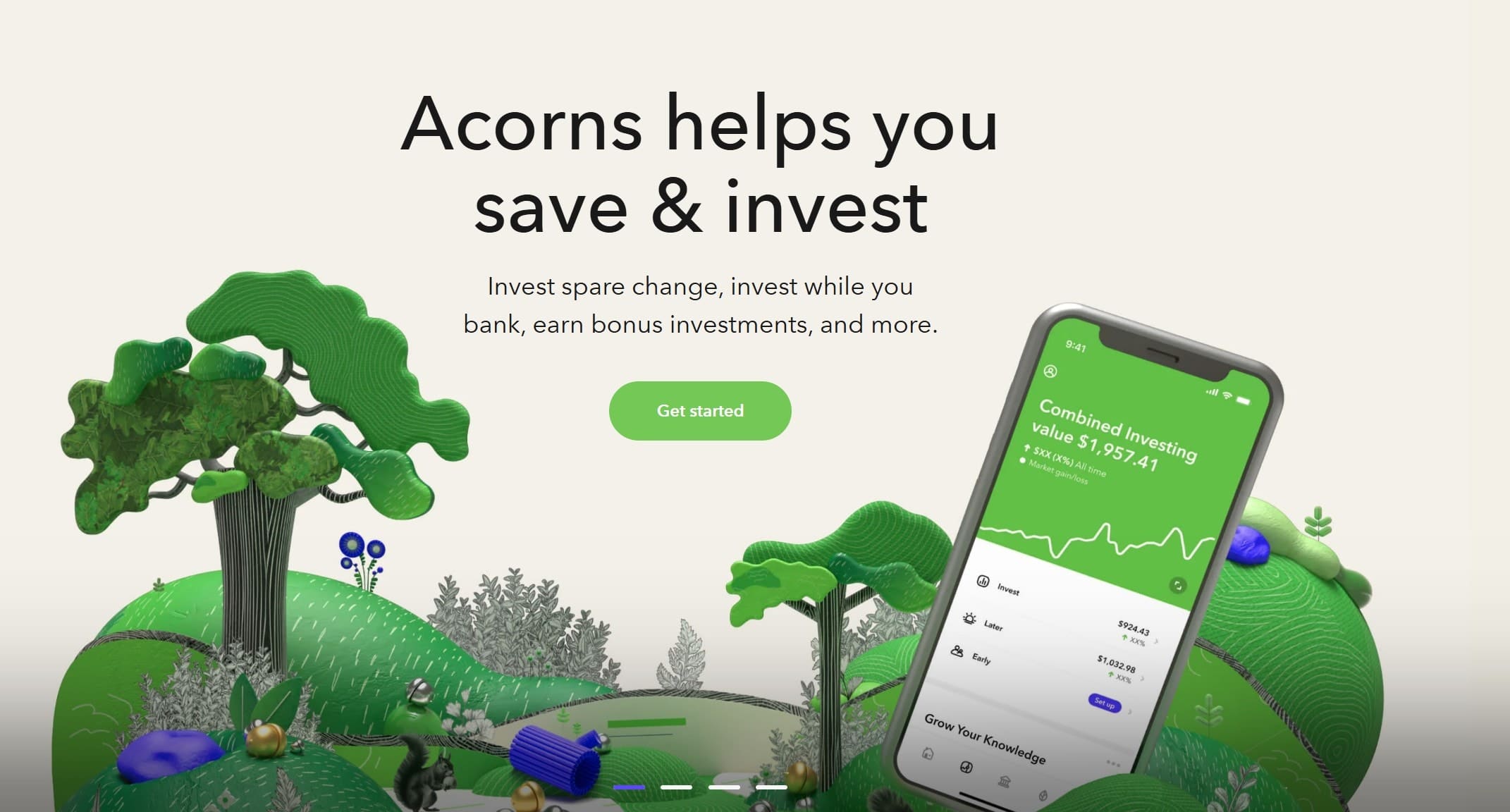

Acorns

Acorns is a standout money-saving app known for its innovative approach to investing spare change. It aims to make saving and investing effortless for its users.

Key Features:

Round-Ups: This unique feature automatically rounds your purchases to the nearest dollar and invests the difference into a diversified portfolio of low-cost index ETFs.

FDIC-Protected Checking Account: Acorns Personal users get access to an FDIC-protected checking account and debit card.

Linked Checking Account: Users can set up a linked checking account to automatically fund their savings goals.

No Minimum Balance or Overdraft Fees: Provides peace of mind by eliminating these common banking issues.

Unlimited Free or Rebate ATM Withdrawals: Accessible ATM services at no extra cost.

Acorns Later: Offers IRA options like Roth IRA, Traditional IRA, or SEP IRA starting with just $5.

Acorns Earn: Provides over 15,000 offers from thousands of popular brands.

Learn Feature: A financial literacy platform that educates users on budgeting, debt, and saving.

Pricing:

Acorns offers three subscription plans. For $3 a month, Acorns Personal users receive real-time round-ups, a checking account, and unlimited ATM withdrawals. Acorns Personal Plus, at $5 a month, qualifies users for an investment match and an emergency fund.

The Acorns Premium plan, costing $9 a month, includes GoHenry debit cards for kids, enhanced investing options, and additional perks. All plans grant access to Acorns Later for IRA investments, making it one of the best money-saving apps for those looking to invest spare change effortlessly.

Download for Android | Download for iOS | Web Version

Chime®

Chime® is an all-in-one financial services app that has quickly become one of the best money-saving apps available. By offering a seamless way to manage your finances, Chime® makes it easier to save money and reach your financial goals.

Key Features:

Automatically Save While Spending: Every purchase with your Chime debit card is rounded up to the nearest dollar, and the difference is transferred to your Chime savings account.

Automatically Save When You Get Paid: Effortlessly save by transferring up to 10% of your direct deposits straight into your savings account.

Competitive APY: The Chime® Savings Account currently offers a competitive 2.00% APY, far exceeding traditional savings accounts.

Get Paid Early: Receive your direct-deposited paychecks up to two days early.

SpotMe®: Eligible account holders with direct deposits can access fee-free overdrafts up to $200, ensuring you never run out of money when you need it most.

No Fees: Chime® comes with no overdraft, service, or foreign transaction fees, making it an economical choice for managing money.

Revenue Model: Chime® makes money from “interchange” fees paid by Visa, ensuring the app remains free for you to use.

Pricing:

Chime® does not charge any sign-up or monthly fees. Instead, it generates revenue through interchange fees on transactions made with your Chime Visa debit card. This allows Chime® to provide a suite of high-quality financial products and features without typical banking fees, making it an ideal choice for anyone looking to save money effortlessly.

Download for Android | Download for iOS | Web Version

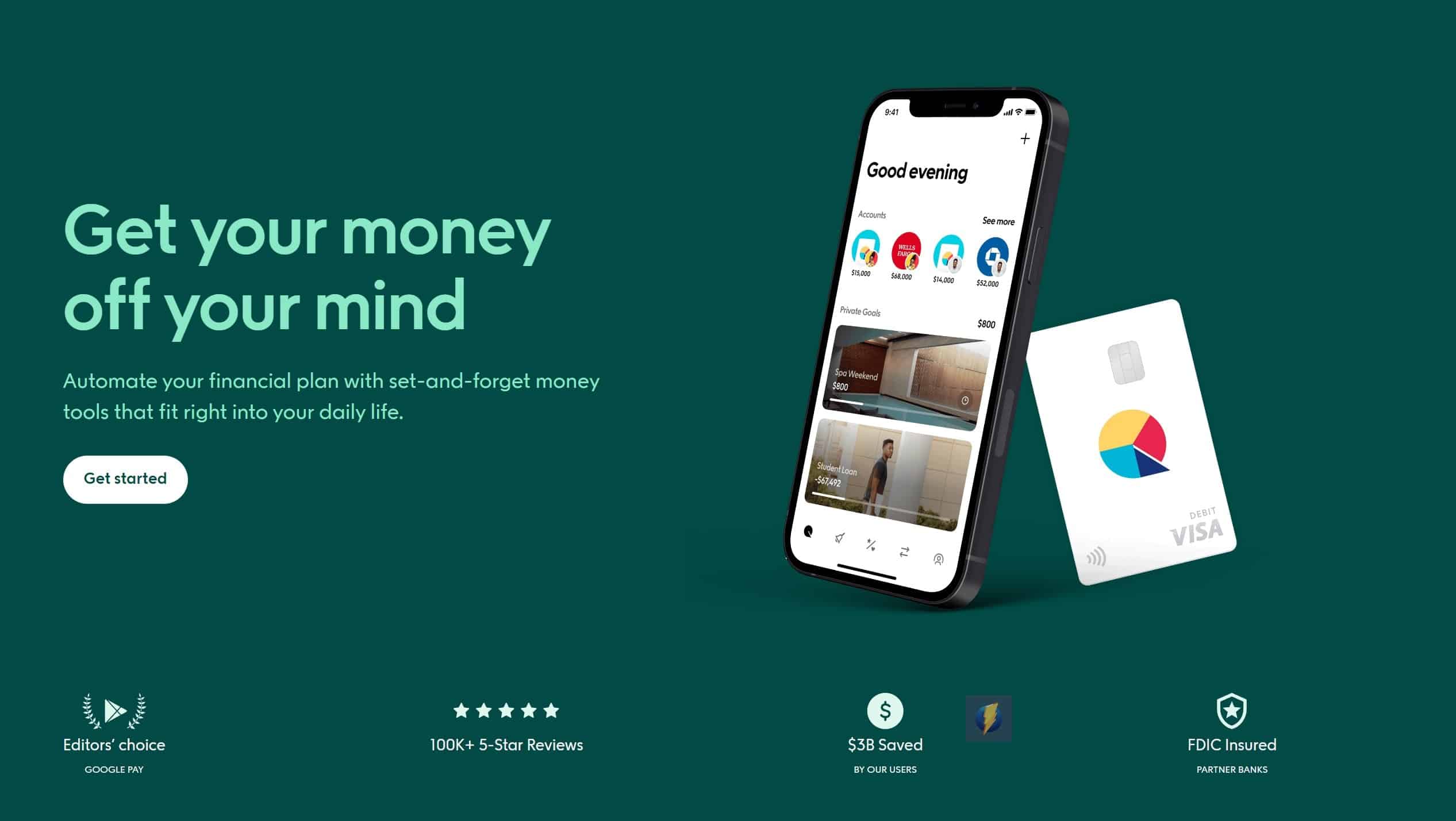

Qapital

Qapital stands out as an excellent money-saving app for those looking to set and save for specific goals. Its innovative method combines behavioral psychology with contemporary technology, enabling users to easily save and invest using customizable triggers.

Key Features:

Rule-Based Savings: Users can set rules for automatic savings, such as putting aside money every time they complete a certain activity like running a mile.

Qapital Visa Debit Card: This card can round up purchases to the nearest dollar, automatically moving the spare change into one of your savings goals.

FDIC-Insured Account: The Qapital Spending Account offers 0.05% APY and comes without monthly or overdraft fees, though ATM fees may apply.

Qapital Invest: Enables users to invest in stock and bond funds with a minimum starting investment of just $10.

Customizable Goals: Choose personal savings goals and track progress through the app’s intuitive interface.

Automatic Transfers: Link a checking account to automatically fund your goals based on pre-set rules.

Pricing:

Qapital offers a 30-day free trial, after which users can choose between three subscription plans: Basic at $3 per month, Complete at $6 per month, and Master at $12 per month.

Download for Android | Download for iOS | Web Version (Mobile Only)

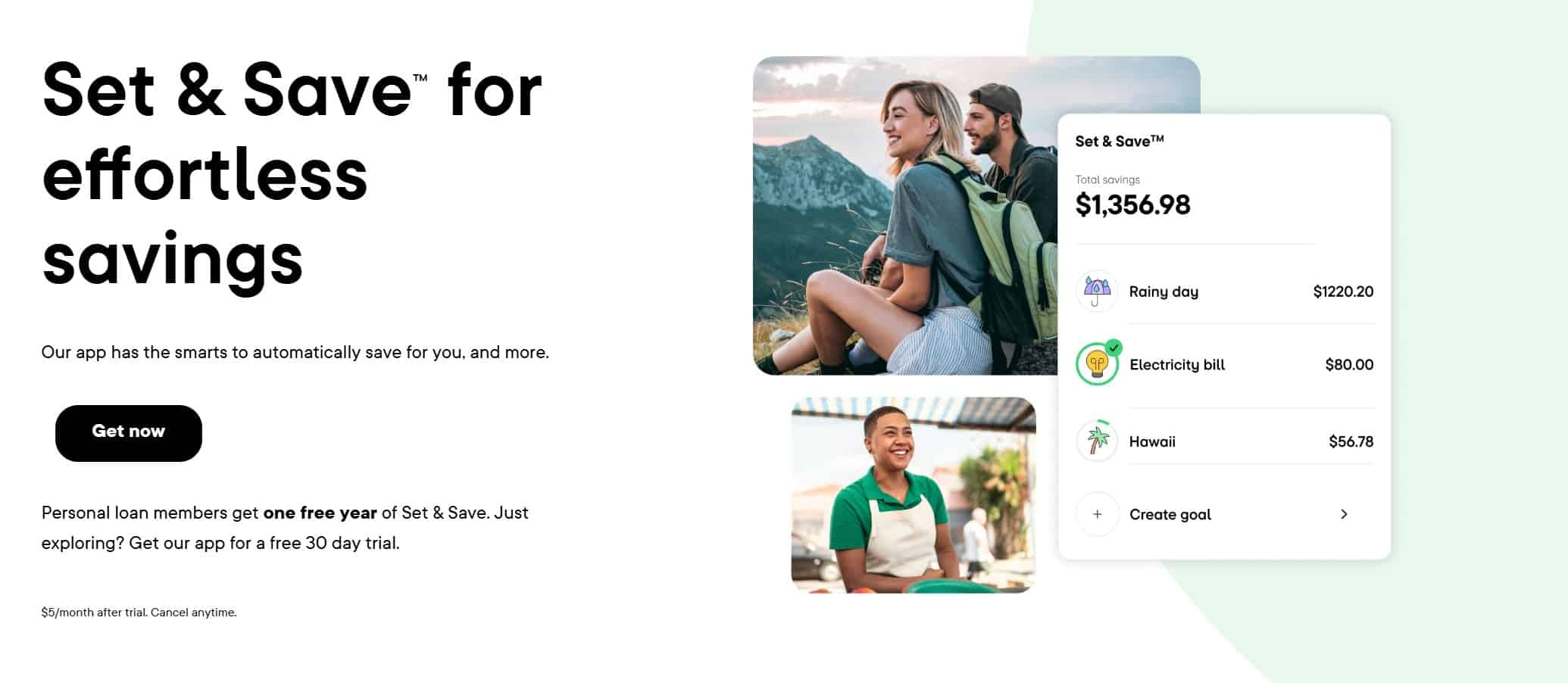

Oportun Set and Save (Formerly Digit)

Oportun Set and Save, previously known as Digit, is an outstanding money-saving app.

In contrast to conventional “round-up” apps, Oportun Set and Save employs automation to scrutinize your spending and income habits. Upon detecting an opportunity for savings, it transfers funds from your external checking account into your Oportun account.

Key Features:

Automation & AI: Analyzes your spending and income patterns to move money when it identifies surplus funds.

Spending Goals: Allows you to set personal saving goals and budgets, automating the savings process.

FDIC-Insured: Your Oportun account is FDIC-insured, adding a layer of security to your saved funds.

Savings Bonus: Earns a 0.10% annual savings bonus if you save consistently for three consecutive months.

Overdraft Protection: Reimburses up to four instances of overdraft fees caused by Oportun autosaves per month.

Pricing:

Oportun charges a monthly fee of $5 for its services, although new users benefit from a one-year free trial. This pricing structure aims to provide value through its sophisticated budgeting tools and automation features.

Download for Android | Download for iOS | Web Version (App Only)

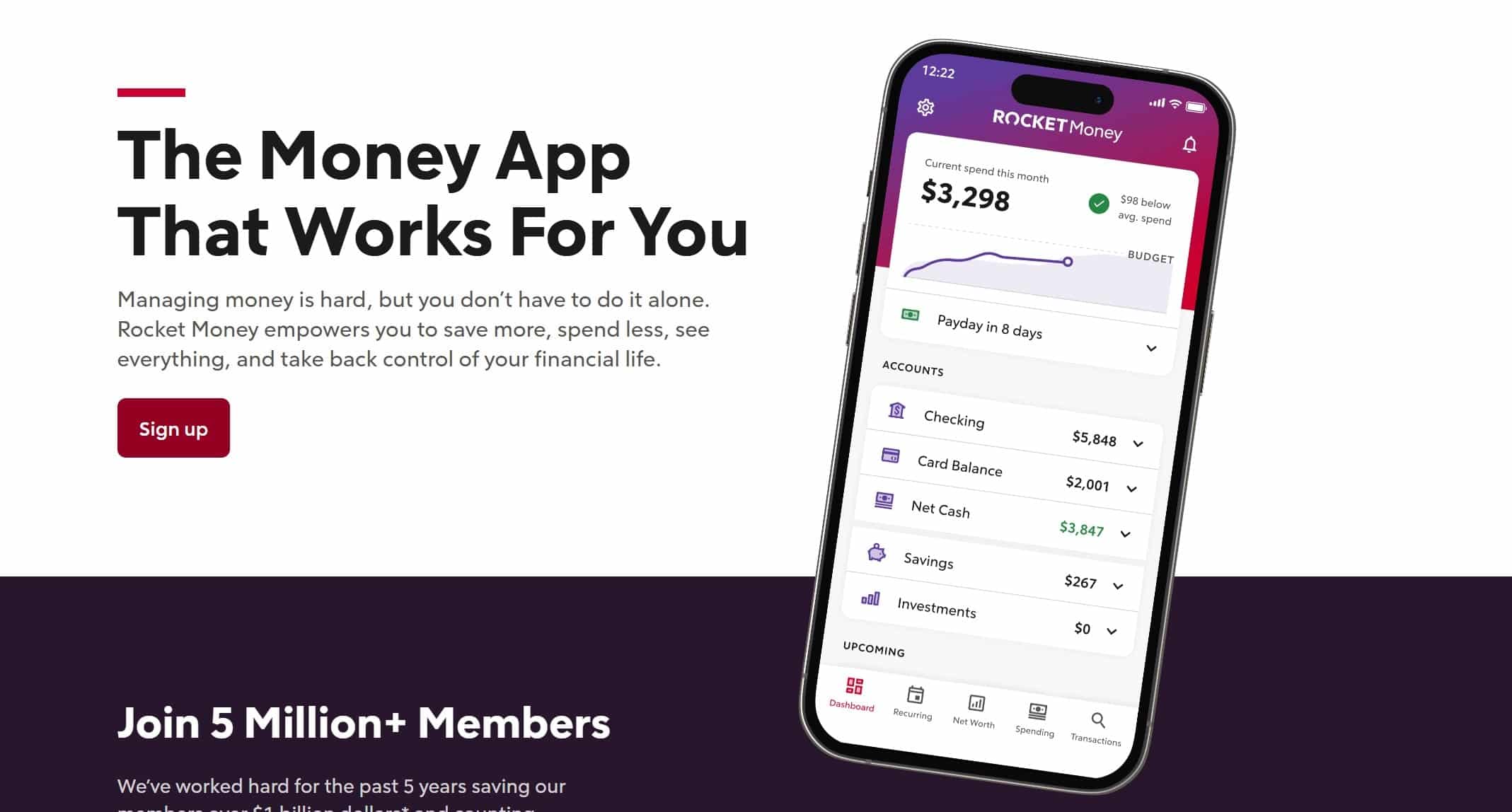

Rocket Money

Rocket Money is a powerful money-saving app designed for those who want to track their expenses effectively. Previously known as Truebill, Rocket Money offers a comprehensive suite of features aimed at helping you manage your finances and save money.

Key Features:

Spending Analysis: Understand your expenditure patterns with detailed analytics, helping you make informed decisions.

Budgeting Tools: Create and stick to budgets tailored to your financial goals, making it easier to save money.

Bill Negotiation: Automatically negotiates better deals on your existing bills, potentially leading to significant savings.

Subscription Cancellation: Identifies and assists in cancelling unwanted subscriptions, consolidating your services into one dashboard.

Automated Saving Options: Helps you save money effortlessly by setting aside funds automatically.

Net Worth Insights: Provides a clear picture of your financial health by calculating your net worth.

Bill Tracking: Keeps track of your payments to avoid missed due dates and late fees.

Pricing:

Rocket Money offers a free version with essential features. For advanced functionalities like cancellation and negotiation services, priority chat support, and enhanced budgeting tools, you can opt for a Premium membership.

The Premium subscription costs between $4 and $12 per month, depending on the payment frequency. This investment might be worthwhile if the app saves you more money than its subscription cost.

Download for Android | Download for iOS | Web Version

Albert

Albert stands out as a top money-saving app by merging checking, saving, and investing into a single platform, streamlining your finances beyond just basic budgeting. It offers numerous advantages that enable efficient money earning and saving.

Key Features:

Albert Cash Account and Debit Card: Get cash-back rewards on groceries, gas, rideshare, and food delivery. Plus, access your paycheck up to two days early.

Albert Budgeting: Organizes your expenses and negotiates bills to save you money.

Albert Investing: Begin investing with as little as $1, making it simple to increase your funds.

Albert Protect: Offers round-the-clock monitoring of your finances with instant alerts for any suspicious activities.

Pricing:

The Albert app is free to start, with no maintenance or overdraft fees, and no minimum balance requirement. Unlock all the advantages by signing up for Genius, starting at just $14.99 a month. Genius subscribers gain access to a team of financial advisors and the Albert Protect service.

Download for Android | Download for iOS | Web Version (App Only)

Allo

Allo stands out as a unique budgeting app designed for individuals who don’t typically enjoy budgeting their bank accounts. The app focuses on mindful money management, considering both your financial goals and mental well-being. It’s ideal for users who struggle to stay motivated by numbers alone, as it emphasizes values over strict budgeting categories.

Key Features:

Mindful Budgeting: Focuses on your monthly values like health, relationships, and future goals instead of traditional categories such as groceries and insurance.

Introductory Course: Guides you through an initial course where experts share tips on gaining financial confidence and gratitude for what you have.

Expense Flagging: Enables you to mark expenses for later review to ensure they match your personal values.

Emotional Awareness: Encourages you to be conscious of your feelings around money, serving as a game-changer for budgeting.

Pricing:

Allo offers a 14-day free trial with no credit card or commitment required. After the trial period, the app costs $49.99 per year. For individuals who find the cost prohibitive, scholarships are available for those who demonstrate financial need. This makes Allo one of the best apps to help save money while promoting mindful spending habits.

Download for Android | Download for iOS | Web Version (App Only)

Frequently Asked Questions (FAQs)

What is the best round-up app for saving money?

With round-ups, your purchases are rounded up to the next dollar, with the difference going into a savings or investing account. Acorns and Chime are popular and highly rated round-up tools designed to make saving a breeze. These money-saving apps automatically invest your spare change, helping you grow your savings effortlessly.

Why To Use Apps To Save Money?

Money-saving apps assist in monitoring spending, setting budgets, and enhancing financial decisions. Various apps offer unique features to save money, enabling automatic spending tracking and insight into expenses. Users benefit from personalized financial tips, including investment strategies, debt reduction, saving tactics, credit score improvement, and wealth accumulation. These apps empower individuals to manage finances effectively, aiding in budget adherence and future planning.

How To Choose the Best Money-Saving App?

Money-saving apps aim to accelerate savings goals. To choose the right one, consider your goals: specific purchases or investments. Evaluate features like budgeting tools and AI-driven savings. Check for fees and read user reviews to gauge ease of use. Utilize free trials or versions to test multiple apps before committing. Examples include Qapital for multiple goals and Acorns for automated investments.

Are money-saving apps safe?

Many money-saving apps are safe to use. Legitimate ones are transparent about how they use and protect your personal information. If you’re unsure about an app, it’s crucial to research the company thoroughly. Start by reading online user reviews and checking the app’s ratings on Google Play or the Apple App Store. Pay attention to download statistics as well. Always ensure that the app has multiple security measures in place to safeguard your financial accounts.

Conclusion

In conclusion, leveraging the best money-saving apps can significantly simplify the management of your financial accounts, helping you track spending, save money, and achieve your savings goals faster. From budgeting tools to automatic saving features, these apps offer everything from high-yield savings accounts to linked checking accounts for a comprehensive financial management experience.

Choosing the right money-saving app is a smart step toward cultivating healthy financial habits, whether you’re looking to invest spare change, build an emergency fund, or simply manage your everyday expenses.

By integrating these powerful tools into your daily routine, you can streamline your savings, optimize expenditures, and pave the way to a secure and prosperous financial future. Whether it’s a traditional bank account or a modern digital solution, there’s a money-saving app that perfectly fits your needs.